I believe we are in the beggining of a new era of investing, like the one we saw in the 1980s with stocks. I wish I could invest in stocks back then in 1980s, before it became mainstream. Right now, a new market is emerging, and we are in a similar situation like it was many years ago when Stocks Market just started blooming.

History of Stock Trading

Look how the stock market evolved over the years, and the History repeats itself.1792 - NY Stock Exchange was founded.

1867 - NYSE installed the first stock ticker. Enabled real-time price updates for traders, vastly improving market efficiency and communication.

1920 - Retail investors flooded in. Stock trading became mainstream among the public

1960 - It is a global financial hub. Massive institutional and public participation

1990 - the 401(k) was the default retirement plan for most U.S. employers. Surge in retail investing. It made millions of everyday Americans stock market participants—many for the first time.

History of Crypto Trading

Let's compare how Crypto Trading is evolving.2009 - Bitcoin was created. The first decentralized cryptocurrency, paving the way for the entire crypto market.

2010 - First bitcoin purchase. On May 22th. A developer named Laszlo Hanyecz paid 10,000 BTC for two Papa John’s pizzas ($41 back then, or $1.2 billion dollars in today's prices).

2012 - Coinbase was founded in the U.S. The first decentralized cryptocurrency, paving the way for the entire crypto market.

2015 - Ethereum was launched. Introduced smart contracts and decentralized applications (dApps), expanding the use cases of blockchain technology.

2017 - Initial Coin Offerings became a popular fundraising method for new projects, leading to a surge in new cryptocurrencies.

2017 - Binance launched and quickly became the world’s largest exchange.

2020 - Institutions entered the game. Companies like Tesla, Square, and MicroStrategy added Bitcoin to balance sheets. Crypto ETFs and custodians emerged.

2024 - Crypto is approaching mainstream adoption. Spot Bitcoin ETFs were approved. 401(k) providers began offering crypto exposure. Regulation, compliance, and Wall Street interest surged.

The Era of Democratized Stock Trading (1980 - 2000)

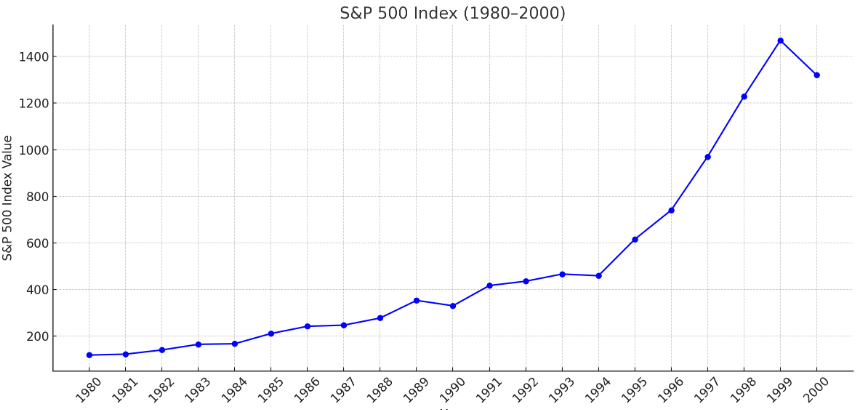

This particular period is a spectacular illustration of what happens when stock trading goes mainstream. Stocks surged for two decades largely because owning stocks became the norm, and trading became accessible to everyone—not just brokers. Investing transitioned from a niche activity among elite traders to a common strategy for everyday households.

This period represents a compound annual growth rate (CAGR) of approximately 13.5% over twenty years.

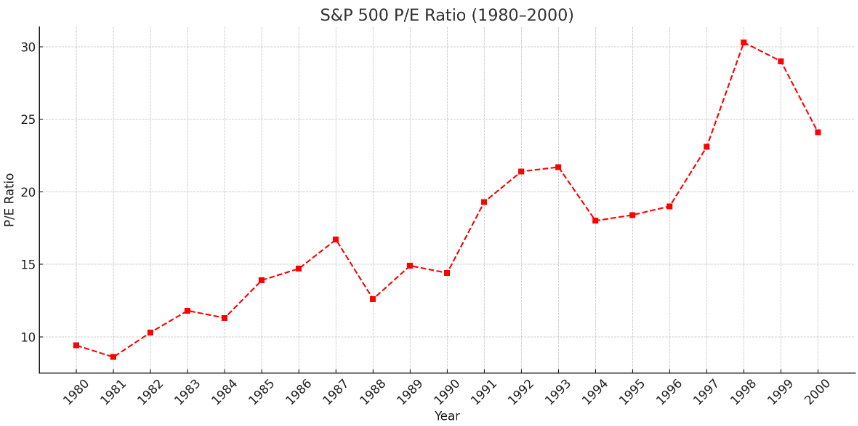

You can see how P/E ratios expanded significantly, especially during the 1990s, indicating that valuation multiples were rising—not just earnings. In simple terms, it wasn’t earnings driving the growth, but the increasing number of participants entering the market and buying stocks. The conclusion is simple: if you enter the market before it goes mainstream, you can more easily multiply your money.

The Era of Democratized Crypto Trading (2024 - 2032)

Here is why everyone thinks that the same thing is happening with crypto (note, below are the facts that you can easily verify yourself):

- The President of the United States has decided to stockpile crypto in the National Reserve.

- The SEC has withdrawn and ended its lawsuits against many major crypto players.

- BTC, ETH, and SOL are now available as ETFs and can be purchased through regular brokerage accounts.

- Crypto is available through Fidelity Investments.

- Crypto is available in 401(k) plans.

It’s typical for early adopters to be rewarded generously, as long as you recognize the potential in all of it.

I'm not making any predictions here, and I leave it to you to draw your own conclusions.

Analogy between Cryptos and Stocks

We can say that the stock market is a well-established and regulated financial system, while the cryptocurrency market is relatively new and still evolving. But the real problem is that most people don’t think of crypto as an investment— as something very similar to stocks. They think stocks represent factories, goods, buildings, people, and jobs, while crypto is just a few bytes on a computer and a hash. Below, I try to bust this myth and show you that crypto has many commonalities with stocks.

| Feature | Applicable to Crypto |

|---|---|

| Market Cap | Market capitalization applies to stocks, i.e. Microsoft (MSFT) market cap is $2.7T. It also applies to the stock market as a whole, i.e. the NYSE has a market cap of $30T. The same applies to crypto, i.e. Bitcoin (BTC) market cap is $1.6T. And the same applies to the crypto market as a whole, i.e. the total crypto market cap is $2.7T. |

| Outstanding Number of Shares | In crypto, this translates to Limited Supply and Circulated Supply. For example, there are only 21 million BTC, and 19 million (out of those) are already mined. This makes market cap meaningful, and owning a certain number of tokens gives you ownership of a proportional share of the total outstanding supply of that cryptocurrency. |

| Price | Crypto currencies are traded on exchanges, over the counter, there are bids with ask price, offer price and spread. Prices are changing every second, you will see charts for all different periods. Most cryptocurrencies that are traded on exchanges are liquid enough, and you can buy and sell them at any time. |

| Trading Volume | Crypto Exchanges also measure the trading volume and you can find these metrics posted. For example, XRP with 122B market cap has 24-hour trading volume of 3B. |

| RSI |

The Relative Strength Index (RSI) is used to identify overbought or oversold conditions of cryptocurrencies too.

Here is RSI of Cronos (CRO)

|

| BETA | The concept of Beta absolutely applies to crypto. Imagine BTC is like SPY. When it goes down 2%, many other cryptocurrencies go down 20%. |

| Penny Stocks | We used to see majority of stock prices between $10 and $100, and this is not a coincidence. There is a standard (aka unsaid rule) and the number of shares is chosed so to follow this as a best practice, and this has certain use cases. For example, if a stock prices is below $3 it is considered a declining company, and you need to sign a waiver to buy it, and you can't even buy such stocks for you 401k. Cryptocurrencies also have a target in mind, and it seems like they choose the number of tokens such that its price would be above $1 as an indication of a success. For example, BlockDAG (BDAG) is something like $.0002 now and the total supply is chosen such that it would be $1 by the time when the market cap would reach $150B similar to XRP. This brings certain convenience to the investors, and if you see a cryptocurrency with a price above $1, then it is likely a well established company with a good adoption (just don't use it as a rule, only as a first impression). |

| Insider Trading | With stocks, when i.e. CEO of a company buys or sells shares, a form 4 is filed to SEC, so that everyone can see it eventually on SEC web site. With crypto, all transactions are recorded on a blockchain and everyone sees them, and you can see those insider trades from the blockchain explorer. For example, the very first wallet with Bitcoin likely belongs to its creator, and even not having a name on a wallet there are services that actually put efforts into tracking those big wallets. In 2025, Mantra (OM) executives moved 12 million OM tokens from their wallets to exchanges, which alerted the community within minutes, and OM price plunged 91% in 24 hours. |

| Ownership (portion of business) | In the traditional world of money, we think of a stock as a portion of a business. When you own shares of a company like Facebook (FB), you own a fraction of that company. Upon closer look, when you own a token, you also own a portion of a business or network. For example, if you bought Monero (XMR) tokens, remember that there was $20 million raised during its ICO to launch the project— and behind that are computers, people, jobs, and an entire operational network. By holding tokens, you own a fraction of that future. |

| IPO (initial public offering) | There is also ICO (Initial Coin Offering). When a company starts a new project, it can raise money by selling tokens to investors. For example, in 2017, the company Block.one raised $4 billion in an ICO for its EOS project. |

| Inflation | In crypto, Inflation also happens, while it is mostly orchestrated by design. Looking at Solana (SOL), SOL has ongoing inflation to reward validators. Initial total supply was 500 million SOL. Inflation starts at ~8% annual inflation rate and decreases by 15% each year until it reaches 1.5% annual inflation. As of right now the circulating supply: ~440–450 million SOL. Total supply: ~560–570 million SOL (grows slowly due to inflation). |

| Central Bank Authority | In the traditional world of money, we think of a central bank as an authority that can print money. In the crypto world, the contract is such an authority that can create new tokens, while the algorithm is well known in advance and visible to everyone. For example, Ethereum (ETH) has a monetary policy that dictates new token creation for validators, while a portion of transaction fees (the base fee) paid by users is burned. In many cases, more ETH is burned than created—making ETH potentially deflationary. |

| Interest Rate | The FED sets the interest rate for the US dollar, and it impacts everything—including stock prices. In crypto, the interest rate is set by the market and it is called APR% (Annual Percentage Rate). For example, if you stake your ETH, you can earn 5% APR% on it. If you stake your SOL, you can earn 6% APR% on it. |

| ETF and Mutual Funds | It is called Baskets. For example, there is "Reserve Basket" that contains BTC, SOL, XRP, ETH, ADA, there is "Solana Basket" with SOL, Render, JITO, Jupiter, Cloud, Raydium. There is "DePIN Basket" with Bittensor, Render, Filecoin, Helium, Graph, Grass and so on, which gives you exposure to the entire world DePIN projects. There is even "AI Basket" with NEAR, ICP, FET, AKT. |

| Options | There are options, futures are available to trade for crypto instruments. |

| Ownership | You don't own the fraction of the company, but you own the fraction of the network. And it is not necessarily a bad thing. Imagine XRP as a company goes backrupt, but the network is still alive and well. In other words, it's a different type of ownership - permanent ownership. In the traditional world of money, stocks give you a temporary ownership - that lasts only as long as the company remains public or existent. |

| Dividends | When staking, you get continuous yield of the same token. For example, you own 100 SOL, and you stake it, and every week you get 0.2 SOL every week, so that in a year you have 110 SOL. Besides SOL itself growing in price, you also get more of SOL itself on top of it. Another example: go here and see yield for XRP: https://coinmarketcap.com/currencies/xrp/#yields |

| Market Hours | You won't find 9:30 AM to 4 PM trading hours in crypto. Crypto is traded 24/7, and you can buy and sell it at any time. And this is actually very much disturbig, because you can see a weird picture when the price of bitcoin is not changing for hours, while you see 24-hour change jumping from -5% to +5%, which is very hard to get used to. There is a nice workaround for this - you can use ETF prices i.e. FBTC or FETH in order to get daily prices at 4 PM, so that you can achieve the statistical correctness if you compare price moves with SPY or GLD. |